Mining

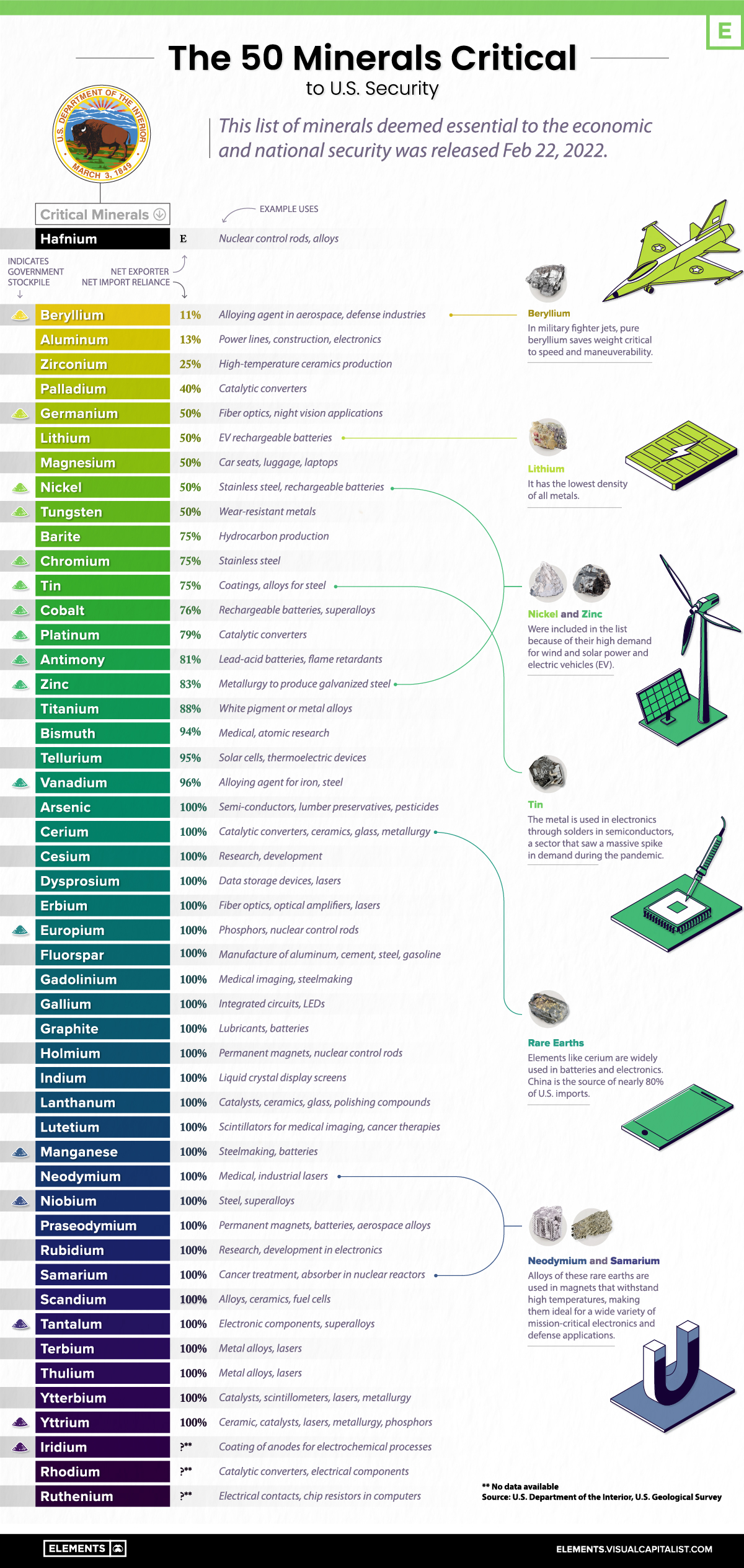

The 50 Minerals Critical to U.S. Security

![]() Subscribe to the Elements free mailing list for more like this

Subscribe to the Elements free mailing list for more like this

The 50 Minerals Critical to U.S. Security

This was originally posted on Elements. Sign up to the free mailing list to get beautiful visualizations on natural resource megatrends in your email every week.

The U.S. aims to cut its greenhouse gas emissions in half by 2030 as part of its commitment to tackling climate change, but might be lacking the critical minerals needed to achieve its goals.

The American green economy will rely on renewable sources of energy like wind and solar, along with the electrification of transportation. However, local production of the raw materials necessary to produce these technologies, including solar panels, wind turbines, and electric vehicles, is lacking. Understandably, this has raised concerns in Washington.

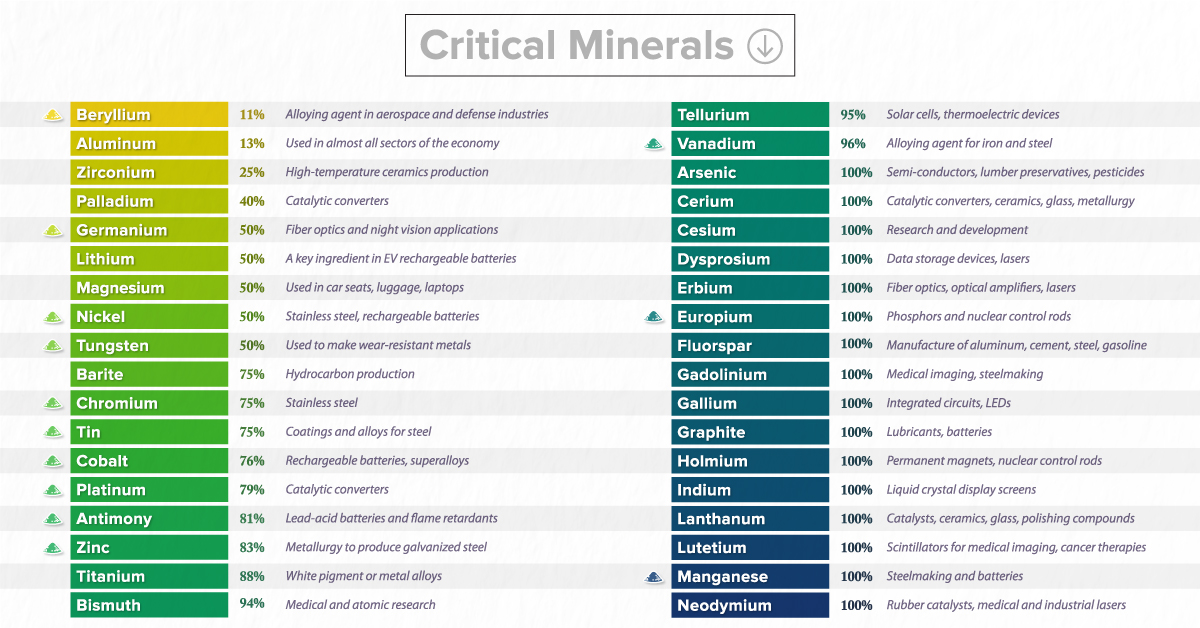

In this graphic, based on data from the U.S. Geological Survey, we list all of the minerals that the government has deemed critical to both the economic and national security of the United States.

What are Critical Minerals?

A critical mineral is defined as a non-fuel material considered vital for the economic well-being of the world’s major and emerging economies, whose supply may be at risk. This can be due to geological scarcity, geopolitical issues, trade policy, or other factors.

In 2018, the U.S. Department of the Interior released a list of 35 critical minerals. The new list, released in February 2022, contains 15 more commodities.

Much of the increase in the new list is the result of splitting the rare earth elements and platinum group elements into individual entries rather than including them as “mineral groups.” In addition, the 2022 list of critical minerals adds nickel and zinc to the list while removing helium, potash, rhenium, and strontium.

| Mineral | Example Uses | Net Import Reliance |

|---|---|---|

| Beryllium | Alloying agent in aerospace, defense industries | 11% |

| Aluminum | Power lines, construction, electronics | 13% |

| Zirconium | High-temparature ceramics production | 25% |

| Palladium | Catalytic converters | 40% |

| Germanium | Fiber optics, night vision applications | 50% |

| Lithium | Rechargeable batteries | 50% |

| Magnesium | Alloys, electronics | 50% |

| Nickel | Stainless steel, rechargeable batteries | 50% |

| Tungsten | Wear-resistant metals | 50% |

| Barite | Hydrocarbon production | 75% |

| Chromium | Stainless steel | 75% |

| Tin | Coatings, alloys for steel | 75% |

| Cobalt | Rechargeable batteries, superalloys | 76% |

| Platinum | Catalytic converters | 79% |

| Antimony | Lead-acid batteries, flame retardants | 81% |

| Zinc | Metallurgy to produce galvanized steel | 83% |

| Titanium | White pigment, metal alloys | 88% |

| Bismuth | Medical, atomic research | 94% |

| Tellurium | Solar cells, thermoelectric devices | 95% |

| Vanadium | Alloying agent for iron and steel | 96% |

| Arsenic | Semi-conductors, lumber preservatives, pesticides | 100% |

| Cerium | Catalytic converters, ceramics, glass, metallurgy | 100% |

| Cesium | Research, development | 100% |

| Dysprosium | Data storage devices, lasers | 100% |

| Erbium | Fiber optics, optical amplifiers, lasers | 100% |

| Europium | Phosphors, nuclear control rods | 100% |

| Fluorspar | Manufacture of aluminum, cement, steel, gasoline | 100% |

| Gadolinium | Medical imaging, steelmaking | 100% |

| Gallium | Integrated circuits, LEDs | 100% |

| Graphite | Lubricants, batteries | 100% |

| Holmium | Permanent magnets, nuclear control rods | 100% |

| Indium | Liquid crystal display screens | 100% |

| Lanthanum | Catalysts, ceramics, glass, polishing compounds | 100% |

| Lutetium | Scintillators for medical imaging, cancer therapies | 100% |

| Manganese | Steelmaking, batteries | 100% |

| Neodymium | Rubber catalysts, medical, industrial lasers | 100% |

| Niobium | Steel, superalloys | 100% |

| Praseodymium | Permanent magnets, batteries, aerospace alloys | 100% |

| Rubidium | Research, development in electronics | 100% |

| Samarium | Cancer treatment, absorber in nuclear reactors | 100% |

| Scandium | Alloys, ceramics, fuel cells | 100% |

| Tantalum | Electronic components, superalloys | 100% |

| Terbium | Permanent magnets, fiber optics, lasers | 100% |

| Thulium | Metal alloys, lasers | 100% |

| Ytterbium | Catalysts, scintillometers, lasers, metallurgy | 100% |

| Yttrium | Ceramic, catalysts, lasers, metallurgy, phosphors | 100% |

| Iridium | Coating of anodes for electrochemical processes | No data available |

| Rhodium | Catalytic converters, electrical components | No data available |

| Ruthenium | Electrical contacts, chip resistors in computers | No data available |

| Hafnium | Nuclear control rods, alloys | Net exporter |

The challenge for the U.S. is that the local production of these raw materials is extremely limited.

For instance, in 2021 there was only one operating nickel mine in the country, the Eagle mine in Michigan. The facility ships its concentrates abroad for refining and is scheduled to close in 2025. Likewise, the country only hosted one lithium mine, the Silver Peak Mine in Nevada.

At the same time, most of the country’s supply of critical minerals depends on countries that have historically competed with America.

China’s Dominance in Minerals

Perhaps unsurprisingly, China is the single largest supply source of mineral commodities for the United States.

Cesium, a critical metal used in a wide range of manufacturing, is one example. There are only three pegmatite mines in the world that can produce cesium, and all were controlled by Chinese companies in 2021.

Furthermore, China refines nearly 90% of the world’s rare earths. Despite the name, these elements are abundant on the Earth’s crust and make up the majority of listed critical minerals. They are essential for a variety of products like EVs, advanced ceramics, computers, smartphones, wind turbines, monitors, and fiber optics.

After China, the next largest source of mineral commodities to the United States has been Canada, which provided the United States with 16 different elements in 2021.

The Rising Demand for Critical Minerals

As the world’s clean energy transitions gather pace, demand for critical minerals is expected to grow quickly.

According to the International Energy Association, the rise of low-carbon power generation is projected to triple mineral demand from this sector by 2040.

The shift to a sustainable economy is important, and consequently, securing the critical minerals necessary for it is just as vital.

Mining

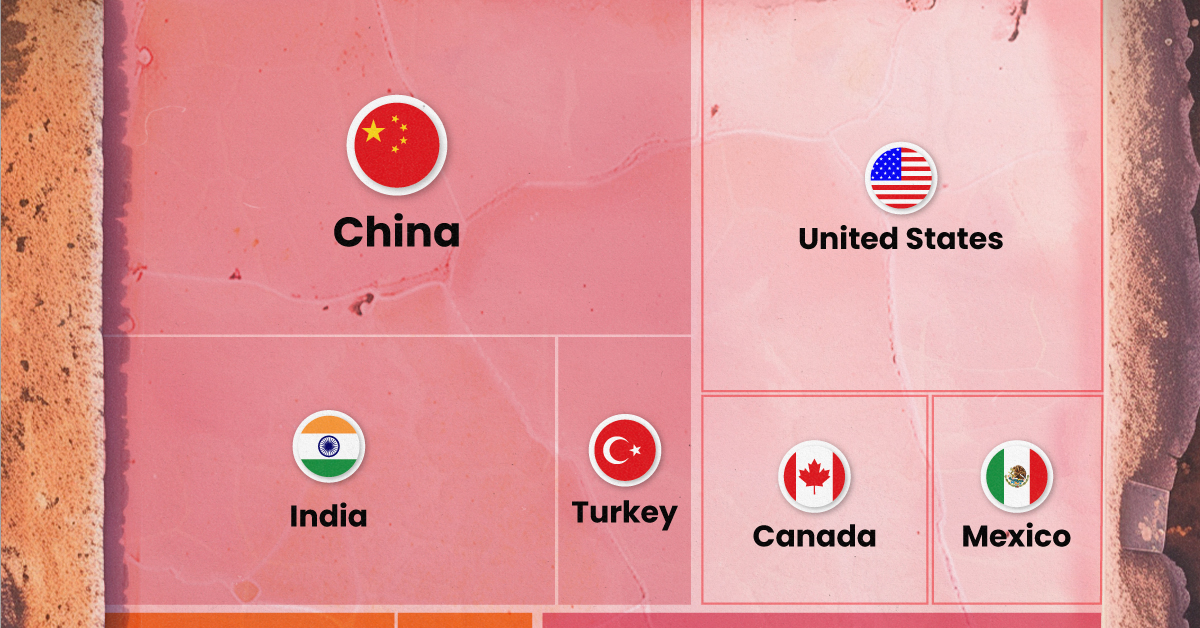

The Biggest Salt Producing Countries in 2023

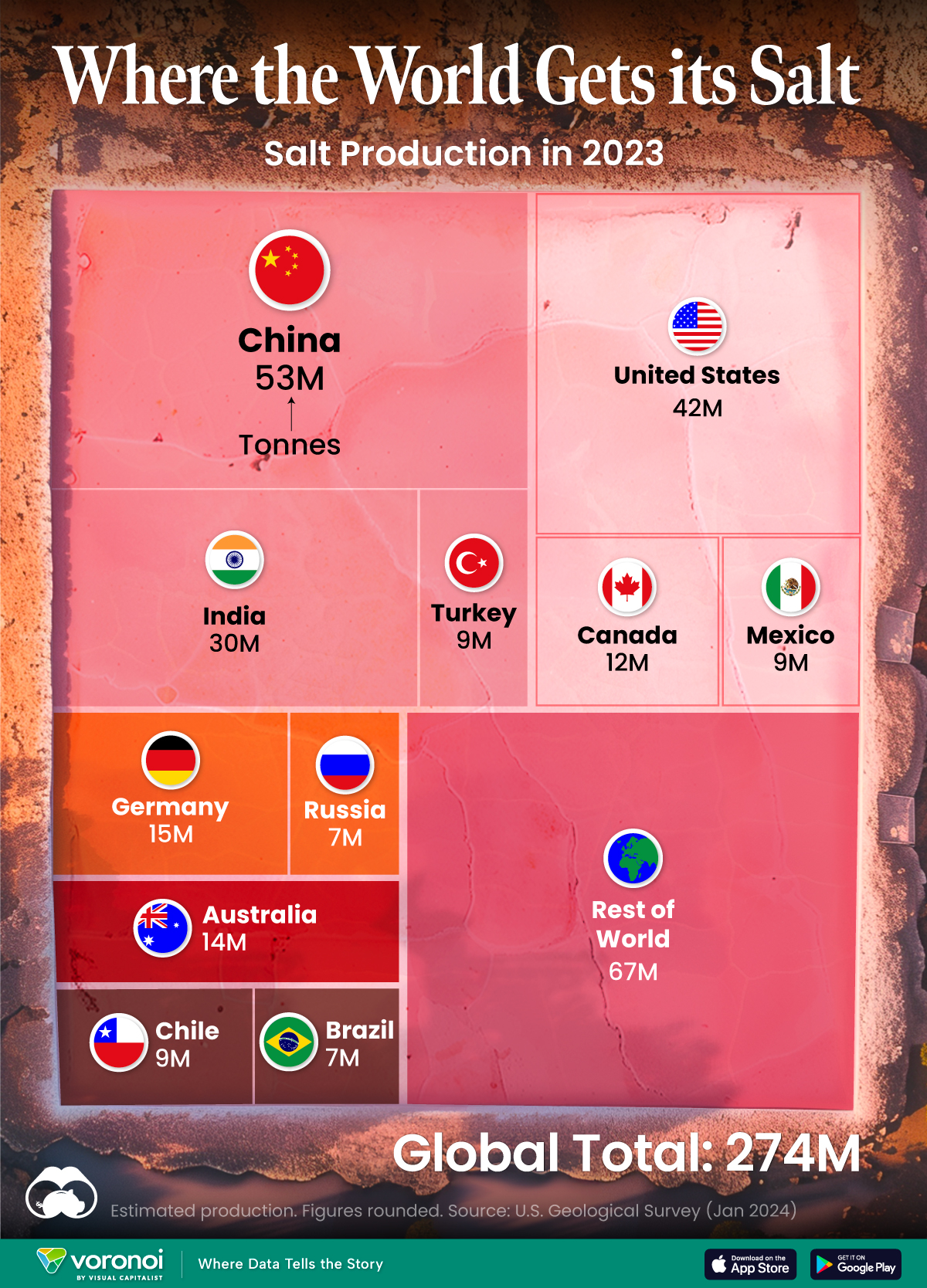

In this graphic, we break down global salt production in 2023. China is currently the top producer, accounting for almost 20% of output.

The Biggest Salt Producing Countries in 2023

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Humanity has utilized salt for thousands of years, dating back to ancient civilizations. The U.S. alone consumes more than 48 million tonnes of salt per year.

In this graphic, we break down global salt production in 2023, measured in tonnes. These estimates come from the U.S. Geological Survey’s latest commodity report on salt.

Ample Supply

Salt is essential for human life, serving various purposes including food preservation, flavor enhancement, industrial processes, and health maintenance. The good news is that the world’s continental resources of salt are vast, and the salt content in the oceans is nearly unlimited.

China is currently the top producer of salt, with almost 20% of the output, followed by the U.S. (15%) and India (11%).

| Country | Production (tonnes) |

|---|---|

| 🇨🇳 China | 53,000,000 |

| 🇺🇸 United States | 42,000,000 |

| 🇮🇳 India | 30,000,000 |

| 🇩🇪 Germany | 15,000,000 |

| 🇦🇺 Australia | 14,000,000 |

| 🇨🇦 Canada | 12,000,000 |

| 🇨🇱 Chile | 9,200,000 |

| 🇲🇽 Mexico | 9,000,000 |

| 🇹🇷 Turkey | 9,000,000 |

| 🇷🇺 Russia | 7,000,000 |

| 🇧🇷 Brazil | 6,600,000 |

| Rest of world | 67,000,000 |

| Global total | 273,800,000 |

The global salt market was valued at $32.6 billion in 2022.

It’s projected to grow from $34.1 billion in 2023 to $48.6 billion by 2030, with a CAGR of 5.2% during the forecast period. This suggests a surprising amount of growth for what is one of the world’s oldest and most common commodities.

Facts About the U.S. Salt Industry

In the U.S., salt is produced by 25 companies, which operate 63 plants across 16 states.

The states that produce the most salt are Kansas, Louisiana, Michigan, New York, Ohio, Texas, and Utah. Altogether, these states account for 95% of domestic production.

The primary uses of salt in the U.S. are highway de-icing (41%), chemical production (38%), and food processing (10%).

-

United States1 week ago

United States1 week agoMapped: Countries Where Recreational Cannabis is Legal

-

Healthcare2 weeks ago

Healthcare2 weeks agoLife Expectancy by Region (1950-2050F)

-

Markets2 weeks ago

Markets2 weeks agoThe Growth of a $1,000 Equity Investment, by Stock Market

-

Markets2 weeks ago

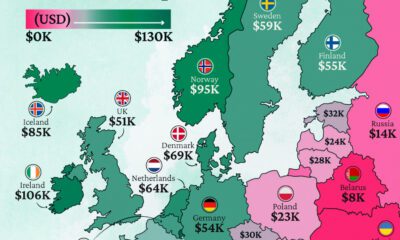

Markets2 weeks agoMapped: Europe’s GDP Per Capita, by Country

-

Money2 weeks ago

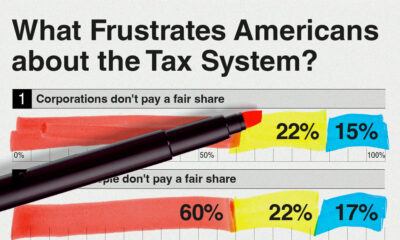

Money2 weeks agoCharted: What Frustrates Americans About the Tax System

-

Technology2 weeks ago

Technology2 weeks agoCountries With the Highest Rates of Crypto Ownership

-

Mining2 weeks ago

Mining2 weeks agoWhere the World’s Aluminum is Smelted, by Country

-

Personal Finance2 weeks ago

Personal Finance2 weeks agoVisualizing the Tax Burden of Every U.S. State